An Update on Activation Group (9919 HK)

Major luxury brands' commentaries on China and some updates from management

Recently, we had the opportunity to attend the "Cartier and Women" exhibition in Hong Kong, organised by Activation Group (9919 HK), and spoke with the management. In this update, we will summarise commentaries on China's luxury market by major brands during 2023Q1 and share our thoughts into Activation Group's revenue prospects for the year.

“Cartier and Women” Exhibition. Image from Hong Kong Tourism Board

Executive Summary

We are optimistic about the recovery of the Chinese luxury market, as indicated by recent updates from major luxury brands. They continue to report strong performance in China, with LVMH, Activation Group's largest client, being the most optimistic. In fact, LVMH expects to see sustained recovery throughout 2023.

Activation Group's management is also confident in the company's revenue prospects for 2023, and has no plans to increase headcount. We maintain our base case of RMB1B revenue and a 10% net income margin for 2023.

Commentaries on China by Major Brands

We have observed that major luxury brands are reporting recovery in China, with varying degrees of optimism. LVMH stands out as the most bullish, which bodes well for Activation Group's prospects.

LVMH

LVMH is extremely optimistic on the rebound in China not just for 2023Q1 but the whole year. In LVMH’s 2023Q1 revenue call, China was well covered by both the management and the participating analysts.

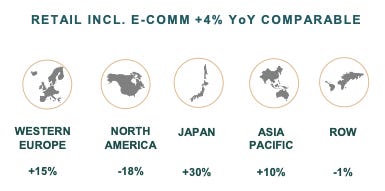

Source: LVMH

Jean-Jacques Guiny, LVMH’s CFO:

“The first question on China, you know that we don't disclose specific numbers for Mainland China. The growth for Fashion and Leather was double digit. In the first half -- in the first quarter, sorry, of the year. I will not really answer into details on the sequence January, February, March, not that easy to read as always, with Chinese New Year, not always being at the same time in the year.

But all in all, I mean, we registered some pretty nice pickup in China, which bodes well for the rest of the year. We definitely see a normalisation of this market with people returning to our stores with the Internet business picking up so we are really back to where we were prior to the complicated period of 2022 so we are extremely hopeful and should benefit from a strong push from Mainland China in 2023. Certainly in Fashion and Leather, but probably as well in jewellery, so other categories will take a little bit of time to recover. Cosmetic remains a little bit under pressure in Mainland China. I'll discuss later on cognac as you have a question -- specific question on that.

But overall, we are extremely optimistic, and we think that the numbers that we have seen in Q1 bodes well for the rest of the year.”

“What we see in luxury sounds as a pretty solid rebound. And if we look over 2 years, the growth for Fashion and Leather in Q1 is above 20%. So that's really a good sign of what's going on. And as I said, I mean, we are extremely optimistic for the rest of the year. We are not talking about frantic or excess optimism and growth in China, we are talking about normalisation at a fairly high level.”

Kering

Kering also sees recovery in China according to their 2023Q1 revenue call.

Source: Kering

Jean-Marc Duplaix, Kering’s CFO:

“Asia Pacific went back to positive territory, up 10% compared to a 19% decline in Q4. The improvement was, of course, driven by Mainland China, our houses benefiting gradually from the reopening of the market. Hong Kong and Macao rebounded sharply.”

“We have a clear recovery and even an acceleration on the Chinese cluster along the quarter, of course, due to the easier comp base.”

“But clearly, month after month and especially starting from mid-March, there was an acceleration in terms of trends in Mainland China. Of course, starting with Mainland China but also, of course, with more and more Chinese traveling, first of all, in Asia, and starting at the end of the day, first of all, in Macao and Hong Kong. And so as a result, if we look at the Chinese cluster, the trends across the board, if we look at all the brands, they are all double-digit up on the Chinese cluster.

There is clearly a shift of the traffic or part of the traffic to Macau and Hong Kong. We consider that in Macau and Hong Kong, these are Chinese clients who could bought have also in Mainland China. So if we look at Greater China as a whole, all our brands are quite strong and especially with an acceleration -- sequential acceleration.”

Interestingly, Kering’s CFO made it clear on the call that they will continue to promote Gucci’s brand perception in China. Hopefully this means more business for Activation.

“We need to continue to elevate the brand perception. And of course, you can imagine that the exhibition that will start in a few days in Shanghai, which is really a unique exhibition. It's really brilliant, will contribute to elevate the brand perception, but it will be not sufficient, as you can imagine. So we have a lot of other actions around that with also more celebrities, some more communication, new ambassadors, not only from China but also from Asia, but with an impact on Chinese -- on the Chinese market.”

Hermès

While Hermès did not cover China as much as LVMH and Kering in their commentaries, it is very clear that Greater China performed quite well in 2023Q1.

Hermès’ statement on 2023Q1 sales:

Asia excluding Japan (+23%), driven by a very good Chinese New Year, pursued its strong momentum in Greater China and across the region, particularly in Singapore, Thailand, and Australia. In January, the Nanjing store, in China's Jiangsu province, reopened at a new address after renovation and extension.

Catching up with Management

We caught up with the management recently after attending the Cartier exhibition.

Expectation for 2023

On the revenue side, it seems to us that the management are quite confident that they can generate more revenue in 2023 than 2021. As of Apr, the number of clients on their 2023 project pipeline hit a new high of over 50. On the cost side, they expect the headcount to stay stable in 2023. This gives us comfort for their major cost items to remain stable this year.

Source: Activation Group

Depending on the revenue, we may see some operating leverage in 2023 and hence a net margin higher than our projected 10%.

Beyond 2023

While the management team is not looking to add headcount this year, they expect to hire more staff in their Digital Marketing and IP Development segments in 2024 to grow these two segments. We should expect these two segments to grow with more resources.

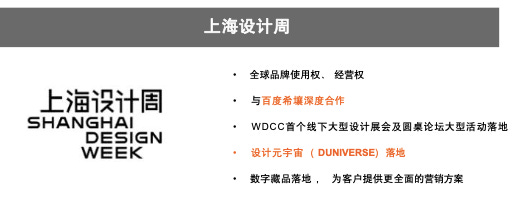

We believe there is a lot of potential in its IP Development segment, in particular Shanghai Design Week (SHDW) and the JV with Hong Kong Land in Shanghai. These two projects can have meaningful contributions to the bottom line in the next 3 years if the success of these projects can be replicated to other provinces in China

Source: Activation Group

It is worth noting that we never put too much emphasis on these two segments when valuing the company, so any positive development from these two segments will likely add to our returns.

Dividend

We were informed that Activation has a dividend policy that guarantees a minimum payout ratio of 35%, which can be increased if the company performs well. While we would have preferred a higher payout ratio as part of their dividend policy, we are not overly concerned given the company's past record of high payouts and the absence of significant capital expenditure requirements. Nevertheless, this does create some ambiguity when calculating the estimated IRR.

Disclosure

The author of this article owns shares in Activation Group (9919 HK).

This article is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities mentioned herein. Readers should conduct their own research and due diligence before making any investment decisions. Investing in stocks involves risks, and past performance is no guarantee of future results. The author assumes no responsibility for any losses incurred as a result of using this information.

The views and opinions expressed in this article are purely those of the author and do not reflect the official position of any organization they may be affiliated with. The author has not been compensated in any way by any of the companies mentioned in this article. Please note that the author may buy or sell shares of any of the companies mentioned in this article at any time without further disclosure.