Executive Summary

Oriental Watch is a prominent luxury watch retailer in the Greater China region. While the company offers various brands, the majority of its sales, over 80%, come from its core brands, particularly Rolex and Tudor, a sister brand of Rolex. Over the past two years, Oriental Watch has benefited greatly from the strong popularity of Rolex watches and has rewarded its shareholders with a dividend payout of over 100%.

Currently, the company still trades at a high dividend yield and occasionally at a discount to its book value (which mostly consists of cash, inventories, and retail real estates it owns, which likely have a value higher than that on the book). We anticipate that Oriental Watch will deliver a satisfactory performance for FY 22/23, with a slight decrease in revenue and net profit compared to its peak performance in FY 21/22. Our projected 3-year IRR, including the upcoming dividend to be announced on 20th June, is 6.9% based on the last price of HKD 4.64 (assuming an exit dividend yield of 12%). Some may expect Oriental Watch to benefit from the Hong Kong-China reopening theme. However, we believe that the actual benefit from reopening might be less significant than anticipated.

Brief History

Oriental Watch was founded by Dr. Yeung Ming Biu in Central, Hong Kong in 1961. The company expanded its operations in Hong Kong and became publicly listed on the Main Board of the SEHK in 1993, becoming the first listed watch retailer. In 2004, Oriental Watch expanded its business into Mainland China, and has since grown its presence in the Greater China region.

During the early 2000s, Oriental Watch experienced sales growth, driven by the influx of Chinese tourists in Hong Kong and a growing network in China. At that time, Oriental Watch had a more diverse brand portfolio. Sales reached their peak in 2012, and subsequently declined due to the Chinese government's crackdown on ostentatious displays and luxury gifting among government officials. As a result, inventory levels increased rapidly from HKD 1.21 billion in 2009 to over HKD 2 billion in 2012 (CAGR: 18.2%). Thereafter, Oriental Watch had to gradually clear its inventories amid declining sales.

While this process was challenging, it yielded positive results for investors. First, the company's cash level improved as inventory was reduced. Second, the company decided to focus on core brands, namely Rolex and Tudor, which are easier to sell and require less inventory management. As cash continued to build and it became evident the company had little reinvestment needs, the management implemented a generous capital return policy beginning in 2017, with a payout ratio of over 100%.

Business Summary

As of the latest interim reporting period ending on 30th September 2022, Oriental Watch operates a total of 46 point-of-sales, including 44 physical branches.

The company's business model is straightforward: buying and selling luxury watches in upscale retail stores while maintaining strong relationships with major luxury watch brands, particularly Rolex.

The company divides its business by geographical locations. In the last interim period, China accounted for 65.8% of the revenue and 86.7% of total profit before unallocated costs, interest expenses, and shares of results from associates and joint ventures. Hong Kong, another significant segment contributor, represented 30% of sales and 8% of the aforementioned profit. The company also operates stores in Macau and Taiwan, but in order to keep this article concise, we will focus our discussion on China and Hong Kong.

Rolex and Oriental Watch

Oriental Watch's unique relationship with Rolex and Rolex's distinctiveness are what make the company interesting.

Rolex, along with Tudor, is privately owned by the Hans Wilsdorf Foundation in Switzerland. It is renowned for its exceptional brand image and longstanding partnerships with its business associates. Rolex also tightly controls its supply, which has been limited in the past few years. For a deeper understanding of Rolex, interested readers are recommended to listen to this episode from Business Breakdown.

Rolex maintains high standards for its authorised dealers. To retain authorisation, these retailers must meet Rolex's requirements for store location, interior design, staff service quality, and other factors. Even the approval of new store locations must go through Rolex.

Rolex has been consolidating its authorised dealers and terminating those that fail to meet its standards. For example, King Fook (280 HK) lost its Rolex and Tudor dealership on 1 Apr 2022. Moreover, Rolex has been trimming its global network of authorised dealers even before COVID:

In addition, Rolex is continuing to trim its global network of authorized dealers, which should lead to its most productive partners gaining share and [infinitesimally] better allocations.

While meeting Rolex's standards as an authorised dealer may be challenging, the benefits are substantial. Rolex takes care of its retailers by ensuring a steady supply and allocation of quality watches, protecting them from financial strain.

Oriental Watch was Rolex's first partner in China, assisting the brand in establishing a presence in the country and serving as a wholesaler until the fiscal year 2021/2022, when Rolex took over that role. Through years of dedicated effort, Oriental Watch has developed a special relationship with Rolex. Presently, Oriental Watch is one of the top 3 largest authorised dealers of Rolex in China by store number, benefiting from the brand's luxurious reputation.

Margin Structure

The margin structure of Oriental Watch fluctuates based on the price and bonus of the watches, which correlates with revenue. Over the past five fiscal years, the gross profit margin has ranged from 21% to 32.4%. During the same period, distribution and selling expenses, as well as administrative expenses, accounted for 7-15% and 6-10% of revenue, respectively. These expenses primarily cover labour costs, bonuses, advertising expenses, and rents.

The normalised net income margin during the same period ranged from 5% to 8.9%, largely driven by higher sales and watch prices.

Competition

Today, Oriental Watch is primarily focused on being a Rolex authorised dealer and competes with other authorised dealers of Rolex in the region. The competition in this space is interesting because Rolex has all the power over authorised dealers. Rolex manages the supply to each authorised dealer to ensure profitability, and it avoids creating excessive competition. Rolex is also stringent in approving new retail locations and market entrants.

We anticipate that competition will remain limited as long as Rolex maintains its position as a premium luxury watch brand and upholds its philosophy regarding business partners and supply control.

Enter COVID

Initially, COVID posed a significant threat to Oriental Watch in early 2020 due to the lockdowns in China. The company's stores were closed in February and March 2020, and the production of Rolex watches was disrupted due to factory closures. However, the situation quickly turned around and became favorable for Oriental Watch.

China effectively contained the spread of the virus later in 2020 and 2021, allowing stores to reopen by the end of March 2020. Moreover, Rolex’s popularity reached a new height, evidenced by the rising watch prices in the second half of 2020 and continued until early 2022 due to limited supply and increased demand for Rolex watches.

According to the management, Rolex watches became so popular that some watches were sold within hours of reaching the stores. People’s willingness to spend also helped Oriental Watch cross-sell products of non-core brands and slow-moving inventories. As a result, we saw significant margin expansion in the past two fiscal years and also gradual decrease in inventory balance especially for non-core branded inventory. In FY 21/22, the gross profit margin reached 32.4%, and the net profit margin was 10%. Shareholders were rewarded with a substantial dividend of HKD 0.749 per share.

Reopening Trade?

While it may seem reasonable to expect Oriental Watch to benefit from the reopening of Hong Kong and China, there are nuances to consider:

The supply of luxury watches remains limited and has not improved since the last fiscal year.

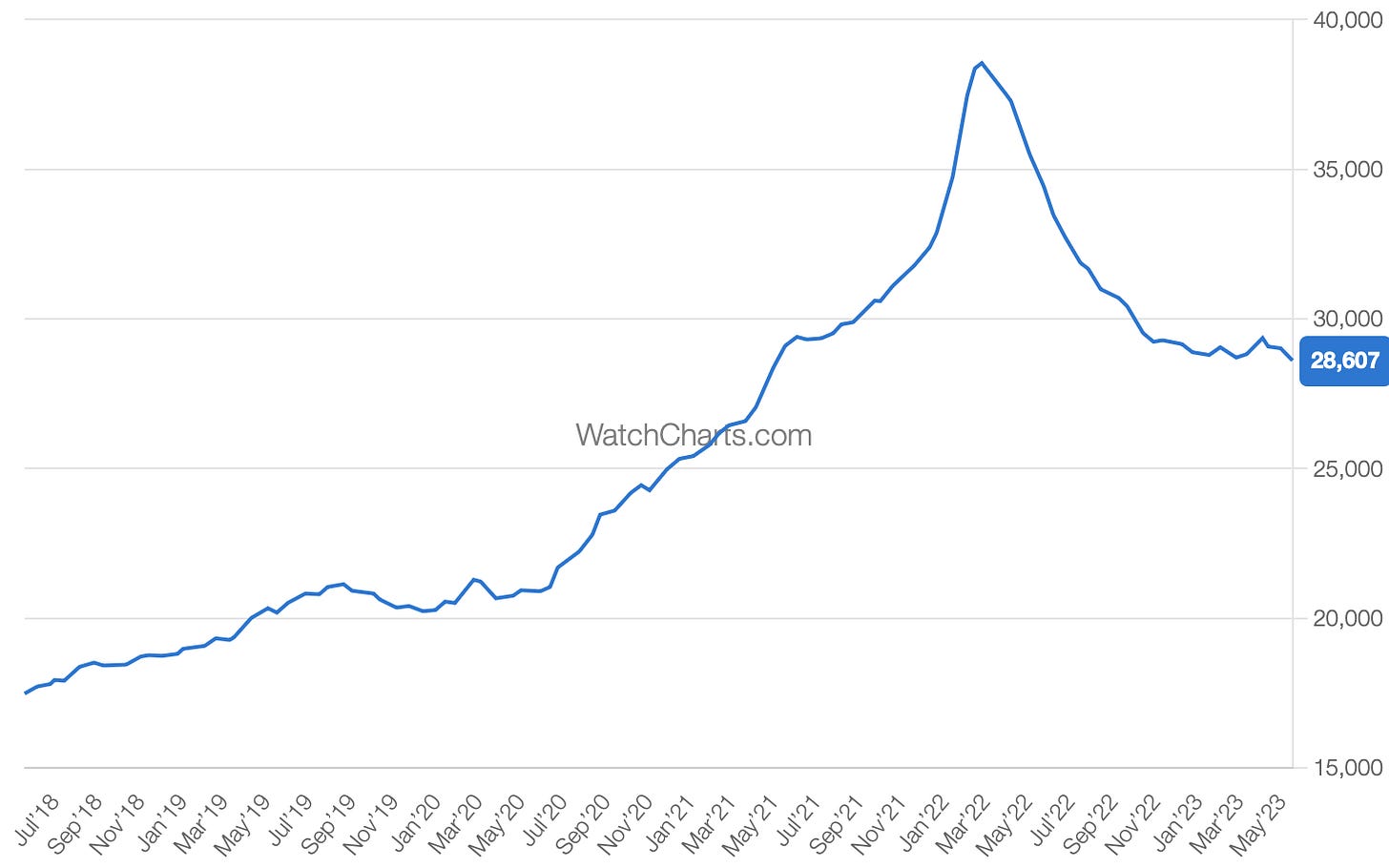

Judging from the Rolex watches price chart, its popularity seems to have reached its peak and is on a decline.

Consequently, sales are expected to decline from their peak levels. Margins have likely also peaked.

Tourism is unlikely to contribute significantly, as luxury watch brands aim to curb parallel trading by reducing sales to tourists. Additionally, Chinese tourists visiting Hong Kong are spending less compared to previous periods. The era of crowded stores filled with Chinese tourists has not yet returned.

Having said that, local demand in Hong Kong and China should remain at a decent level, therefore we do not anticipate a drastic impact on the upcoming financial results.

Capital Allocation

While some investors may view Oriental Watch as an asset play, we think the management has no intention to sell its self-owned retail stores. Having said that, Oriental Watch has a generous dividend policy of a 100% payout ratio plus a discretionary distribution from its cash reserve. The company has been distributing more than 100% of its reported net profit for a few years.

In addition to dividends, Oriental Watch conducted a significant buyback, an uncommon feat in Hong Kong. In September 2020, the company announced a cash offer to repurchase 83,000,000 shares at HKD 3 per share when the shares were trading below HKD 2 per share. Oriental Watch successfully retired all 83,000,000 shares, which accounted for 14.55% of the total shares at that time.

Valuation

Considering the company's reluctance to sell its properties, we primarily focus on the dividend generated from its operations when valuing Oriental Watch.

We expect the company to generate around HKD 3.4 billion in revenue and HKD 270 million in net profit in FY 22/23, equivalent to a P/E of 8.2x based on the share price of HKD 4.64. The estimated final dividend for the upcoming period is conservatively projected to be HKD 0.284 per share, equivalent to around HK$ 290 million of dividend on a full-year basis, a 13% dividend yield.

We anticipate a 10% decline in revenue in FY 23/24, followed by a 5% recovery in FY 24/25, and finally revenue stabilising at HKD 3.26 billion. The net income margin is expected to further decline to 6% in FY 23/24 and then remain steady at 7% from FY 25/26 onwards. Factoring in a 100% payout ratio and a 12% exit yield, the estimated 3-year IRR is 6.9%.

It is important to note that the company's business has historically been cyclical, and we have taken a conservative approach in our estimates. For instance, Oriental Watch is likely to pay dividends exceeding 100%, but we have not accounted for the discretionary distribution from the cash reserve in our analysis.

Risks

Chinese Economy and Cyclicality of Hard Luxury

Demand for hard luxury items such as watches and jewellery is more cyclical compared to fashion luxury. Given the slow recovery of the Chinese economy and the uncertainty in the global economy, it would not be surprising to witness reduced demand for luxury watches and lower watch values. Consequently, this could lead to a decline in Oriental Watch's sales and net profit. While we have factored this into our valuation model, accurately estimating the depth of a down cycle can be challenging.

Crackdown by the Chinese Government

As mentioned in our first article on Activation Group, luxury watches have been used by some individuals to move capital out of China. Rolex watches, in particular, are commonly employed for capital flight, which is currently occurring. We have no idea on how likely a crackdown will be but the impact can be substantial with several years of declining sales and profit.

Rolex's Brand Power and Watch Value

Considering Oriental Watch's high exposure to Rolex, the company has become a proxy for the brand. Oriental Watch's future earnings heavily rely on Rolex's brand and supply management. Any deterioration in Rolex's brand power or a misanalysis of demand/supply from Rolex would have a direct impact on Oriental Watch's financial performance.

Loss of Rolex's dealership

While we consider it a low probability event, it is nonetheless a risk. The company has to ensure its operations and internal control can meet Rolex’s high standards, and maintain a good relationship with the brand.

Directors’ Cash Remuneration

The directors’ cash remuneration has inflated substantially from around 1% to over 3% of total revenue since the founder Dr Yeung Ming Biu passed away in early 2021. While the company explained that it is a cash bonus to reward directors for their hard work, we believe such bonus is excessive given Oriental Watch earns a mid to high single digit of 5-8.9% net profit margin. Absent such remuneration, Oriental Watch could have a high single digit to a low double digit net profit margin. We prefer directors owning more shares of Oriental Watch and earn their “bonus” via dividends. Whether the remuneration will be out of control when Oriental Watch goes into a down cycle is to be seen but this remains a risk for shareholders.

Shift from Multi-brand store to single-brand store

Historically, stores were operated under the banner of “Oriental Watch”, with Rolex being one of the brands that were sold within the store. As Rolex grows in brand power, it requires dealers to operate stores under the banner of “Rolex”, and exclusively sell Rolex within that store.

All else equal, it should be a negative to Oriental Watch, because 1) watch retailers are indistinguishable among customers, and 2) it reduces the ability for Oriental Watch to cross-sell other non-Rolex watches, which still accounts for low teens of revenue. However, we also think if it becomes infeasible for Oriental Watch to operate the non-core brands profitably, it can exit more non-core brands, close or sell unprofitable retail stores, and possibly distribute the proceeds to shareholders. The net impact remains to be seen.

Disclosure

The author of this article does not own shares in Oriental Watch (398 HK).

This article is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities mentioned herein. Readers should conduct their own research and due diligence before making any investment decisions. Investing in stocks involves risks, and past performance is no guarantee of future results. The author assumes no responsibility for any losses incurred as a result of using this information.

The views and opinions expressed in this article are purely those of the author and do not reflect the official position of any organization they may be affiliated with. The author has not been compensated in any way by any of the companies mentioned in this article. Please note that the author may buy or sell shares of any of the companies mentioned in this article at any time without further disclosure.