Before we dive into today’s topic, it is important that we reiterate the purpose of this blog. Investing is a lonely journey, more so for a value investor. We hope we can make this journey a little less lonely - by connecting like-minded people and discussing the companies we find interesting. We are not here to pitch any stocks and to make any investment recommendations. Our analysis is not meant to be the most detailed, for fear of boring most of the readers. So do not hesitate to comment below, or ask questions. There are always more we can share!

With that out of the way, let’s dive into LH Group (1978.HK), another catering group listed in the Hong Kong Stock Exchange besides Taste Gourmet (8371.HK) which we discussed previously.

Industry Landscape

The catering industry has always been a very competitive industry, with long-term success generally being an exception rather than norm, due to low barriers of entry and non-existent switching cost for customers. Caterers quickly reach a ceiling in Hong Kong due to geographic limitation, and generally do not travel well (especially in China) due to various reasons. Some of them even slowly fade away when more competitors try to copy or customers become fatigued with the menu. More so, operational excellence and cost-control capability are of utmost importance for a low margin catering business. Even a strong brand doesn’t guarantee a good outcome for investors.

There are of course exceptions, which we can summarize in the following points:

Unique business models and thoughtful operational philosophies that can lower probability of failure (e.g. Food & Life/Sushiro (3563.JP), Saizeriya (7581.JP))

Products that can be standardized and travel well, usually in the form of franchises (e.g. McDonald’s (MCD), Domino’s Pizza (DPZ), Starbucks (SBUX) etc.)

Capable management that can keep a brand fresh and that is detail-oriented in cost control

Depressed valuation for various reasons

We explain below how LH Group falls under the above exceptions, namely #3 and #4.

Brief History and its “Masking” Effect

We believe the historical financials of LH Group do not paint an accurate picture of its true profitability.

According to LH Group’s IPO prospectus and the CEO Simon Wong’s Facebook page, the Wong’s, Ko’s and Liu’s family started a few Chinese restaurants in the late 70s, and by 1986 opened the first Lucky House (LH) (叙福樓) Chinese restaurant, offering Cantonese style dim sum delicacies and seafood, setting itself apart from traditional mainstream Cantonese restaurants with its sophistication and artistry. At its peak, the Lucky House chain had more than 20 locations In Hong Kong.

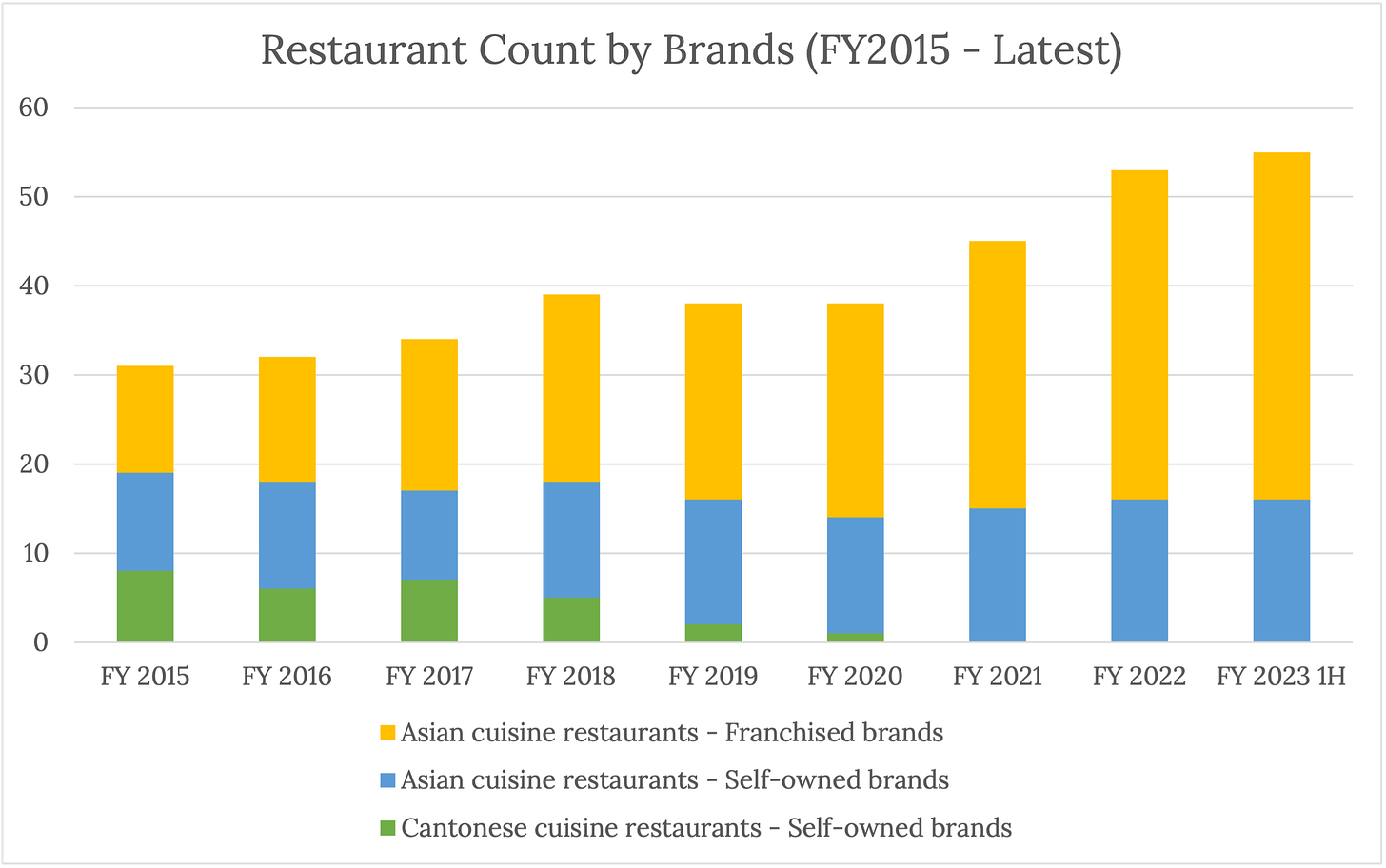

The group was faltering towards the 2000s, and by 2006, Simon Wong, the second generation of Wong’s family, who was an engineer by training, was invited by his father to join the LH Group and help revitalize the company. Simon successfully diversified into other cuisines in subsequent years, through self-developed brands such as “Mou Mou Club”, which specializes in shabu-shabu beef hotpot, as well as franchised brands such as the yakiniku (Japanese grilled meat) specialist “Gyu-Kaku” and shabu-shabu specialist “On-Yasai”. Gyu-Kaku in particular has a strong mind share in Hong Kong, and long queues are often observed outside its restaurants.

Having said that, the transition was gradual. Despite the closure of Cantonese cuisine restaurants over the years, it still contributed to about 30% of revenue by 2017 and 2018. Meanwhile, the margins of Cantonese cuisine restaurants were significantly lower than those of the franchised brands, dragging down the overall profit margins. And from the second half of 2019 onwards, the operation was affected by the social unrest, followed by Covid restrictions. These factors masked the true profitability of the operation for casual onlookers, and we believe such masking effect contributed to the depressed valuation previously. It began to demonstrate its true margin once all Cantonese cuisine restaurants were closed and all covid restrictions were lifted, which is close to 10% compared to mid single-digit previously.

Resilient Financial Performance with Fair Capital Allocation

Due to social unrest and the restrictive COVID measures in Hong Kong, the operating environment was very tough for restaurant operators in the past 4 years. There were 2-4 months in every calendar year in which restaurants were not allowed to operate normal hours. Dining behavior also changed significantly.

Among all the listed restaurant operators in Hong Kong, only Taste Gourmet and LH Group could maintain a resilient financial performance, while also taking advantage of the adverse environment to further restructure its brand portfolio and expand its store network, as evidenced by their improving revenue and net profit margin. In fact, there were only a handful of caterers in Hong Kong that could achieve a net profit margin of 8% or above during 2019 - 2022. Credit to the management for its operational capability amid such a difficult environment.

LH Group has demonstrated a consistent and sensible dividend payout ratio since 2020, and as cash continued to pile up, management distributed part of its excess cash to shareholders via special dividend (with the latest special dividend being announced in August 2023).

(Note: When studying the historical financials of caterers in Hong Kong, please bear in mind there were a lot of covid restrictions (opening hours, seats etc.), one-off rental concessions, or government subsidies in the past few years. As such it might be more useful to focus on relative performance or periods where operations were less disrupted as a proxy for a normalized financial performance, such as that in the last twelve months.)

Two Sides of the Same Coin

We believe LH Group’s strengths are also its weaknesses.

To summarize the success factors of LH Group, we believe it was due to

the success of Gyu Kaku and

Simon’s ability to keep the brand fresh and control costs.

LH Group was in essence the first mover in yakiniku in Hong Kong. It enjoys a strong mind share and people associate yakiniku with Gyu-Kaku. The brand is kept afresh through a number of initiatives, such as a successful mobile app for its membership program of which has over 100,000 active members. Simon also cultivates a positive public image via participating in a reality TV show namely “Rich Mate Poor Mate Series”, maintains a well followed Facebook page and acts as a KOL for LH Group to help promote the group’s restaurants. For example, his recent Facebook post on latest business development attracted 3,000+ likes from his audience. He also often responds to customers’ complaints via his Facebook page. Also, based on our conversations with employees, Simon pays a lot of attention to costs, which can contribute up to a few percentages of margin difference compared to peers according to our observation.

On the other hand:

LH Group only has one strong brand. Gyu-Kaku generates the majority of LH Group’s revenue and net profit, and Simon’s strength is not in developing or introducing new brands. We argue Gyu-Kaku was a bit of an one-off. LH Group has tried by creating or introducing new brands multiple times in the past 10 years, including Sushi Dai (壽司大), Lazat Laksa (叻沙味道), Nanjing Dong Lu (南京東路), Tamashii (魂), Yoogane (柳氏家), Peace Cuisine (和平飯店), Gyu-Kaku Jinan-Bou (牛角次男坊), Wing Wah Allday (永華日常) and The Matcha Tokyo. Regretfully, none of the above contributed materially to the group. Fair to say they have not found a replicable success formula yet. Adding to the urgency of the issue is that Gyu-Kaku is approaching its ceiling with 25 store outlets already in Hong Kong today. Also, there are an abundance of new entrants in the yakiniku market in recent years, with Yakiniku Like (franchised brand operated by Maxim’s Catering) posing the biggest threat.

Simon’s tendency to prioritize cost cutting results in LH Group renting sub-prime locations where rent is low, such as at the corner of a mall, or in “dead” malls with minimal organic traffic. While it works for Gyu-Kaku which can draw traffic despite being in sub-prime locations, the same cannot be said for other brands it operates.

From a Family Business to a Professionally-run Business

In view of all these potential challenges and in order to bring LH Group to the next stage of growth and development, Simon started to delegate and step down gradually despite being still relatively young. LH Group appointed Ernest Luk as their Chief Executive (Food & Beverage) effective from December 2022 and John Yang as Chief Financial Officer effective from April 2023.

Ernest has 30 years of experience in the industry and held managerial roles, the last being the COO of the Japanese restaurants division in Maxim’s Catering Group, and was instrumental in bringing Genki Sushi and Yakiniku Like to Hong Kong and operating them to great success. John also has around 10 years of experience in the industry, having worked at Tsui Wah (1314 HK) previously as CFO and CEO of their PRC business.

One can argue these appointments should increase the probability of a successful transition from essentially a single brand catering group to a multi-brand one. The early signs are also encouraging, as it recently announced they have secured a franchising agreement with a popular Japanese Hikiniku chain. At the same time, the impact of losing Simon in day-to-day operations remains to be seen.

Valuation

As usual, we do not take into account the excess assets (4 properties) held by the Group and we tend to take a conservative approach in our estimate. We primarily focus on the dividend distributed from its operations when valuing LH Group, and we neither account for successful management transition nor further discretionary distribution from its cash reserve in our analysis.

At the price of HK$0.98, the stock currently trades at 7.9% FY 2022 dividend yield and 12.8% LTM June 2023 dividend yield (excluding the special dividend). We expect LH Group will continue to generate at least around HK$115 million of cash earnings per annum in the coming few years, despite the fact that restaurant count growth may slow down and both revenue and profitability per store may drop slightly. This is equivalent to a dividend yield of 11.7% assuming the payout ratio is maintained at 80%. We estimate that the 3-year IRR is 18% at HK$0.98, based on our projection below and assuming an exit in December 2025 with a forward dividend yield of 10%.

Note: We published an incorrect set of estimates earlier. Please refer to the estimates here for the correct estimates. We apologize for the confusion.

Conclusion

LH Group is currently at a crossroads. We think Gyu-Kaku is an astounding cash cow and will continue to generate substantial free cash flow in the foreseeable future because of its value proposition and brand awareness. However, it remains to be seen whether Gyu-Kaku can maintain its popularity in the face of stronger competition, and whether the new management team can help lead LH Group to its second growth curve. Having said that, its current valuation reflects most of the potential downside risks (backed by over HK$220 million of net cash against a market cap of HK$784 million), while any fortunate attempt in replicating Gyu-Kaku’s success or further increase in payout could provide an unexpected upside. The founding families including Simon hold 75% of shares outstanding and therefore should be in the same boat as us.

Thanks for the write-up! There are unfortunately not that many people writing about HK stocks out there.

Have you looked also at Fairwood (0052 HK) or International Housewares Retail Co. Ltd. i.e. JHC (1373 HK) (own by David Webb)? All of these companies from LH Group (1978 HK) to 1373 to 0052 to even Giordano International Ltd. (0709 HK) (also own by David Webb) have for some reason free cash flow that's for years much higher than operating income. Do you know of a reason why that's the case? Is that something peculiar to HK? Which of the two would you say is more indicative of these companies' worth going forward?

Curious what your view is. Hope you keep the write-ups coming!

just curious if you have looked at 6686 (noah) or 889 (datronix) both look exceptionally cheap....