The beauty industry is typically characterized as a small-scale, relationship-driven business. Barrier to entry is low, but a few groups have successfully tapped the capital market and achieved a certain scale in order to provide delicate medical beauty treatments, where trust by the customers is essential. They have harnessed the societal obsession with a particular standard of beauty, amplified by the influence of social media and advertisements, and have reaped substantial profits.

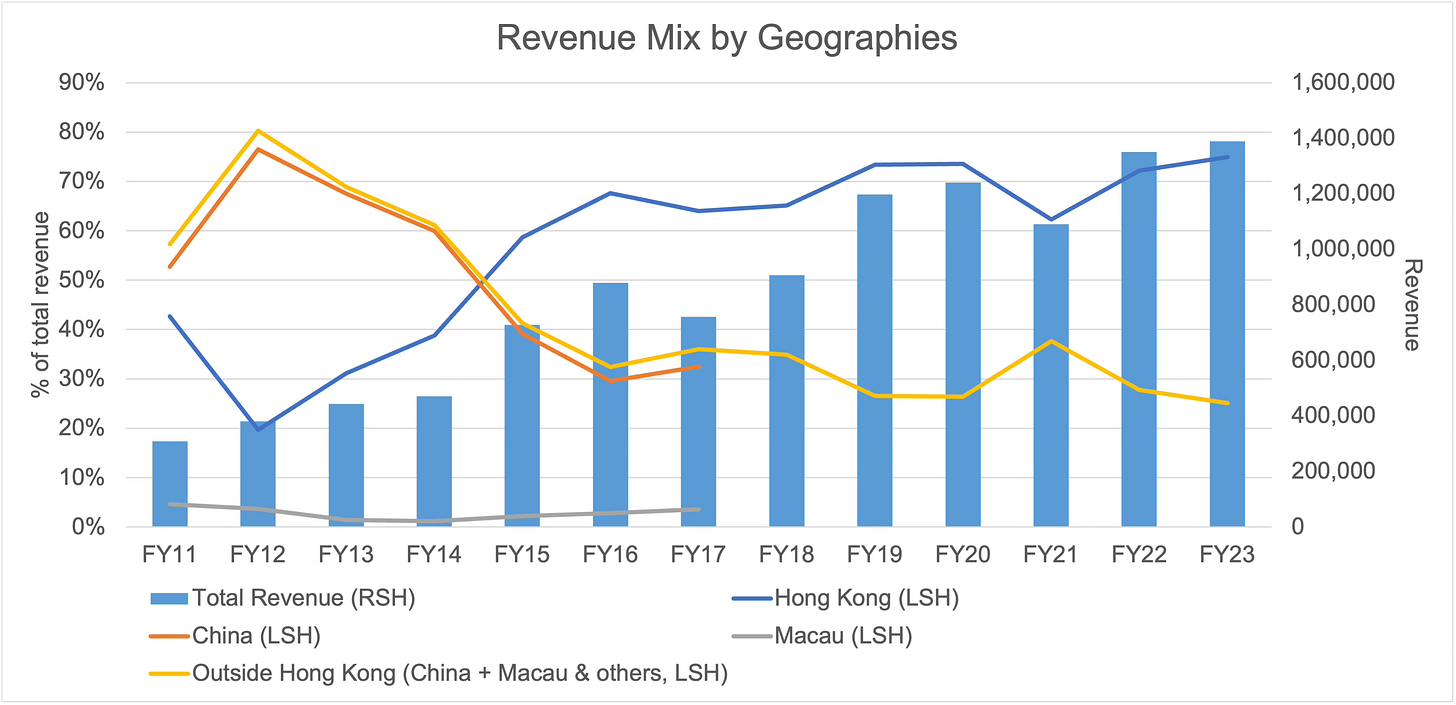

Perfect Medical stands as one of the major players in the beauty service sector in Hong Kong. Originally named Perfect Shape, the company was founded in 2003 by Dr. Au-Yeung Kong in Hong Kong with an initial focus on slimming services. In 2012, it went public with an ambitious expansion plan in mainland China but had since grown itself into a leading player in Hong Kong. Today, it primarily operates within Hong Kong, but its focus has shifted to providing non-invasive medical beauty services since 2015. This transition of its core business from slimming services to medical beauty services has had a profound impact on the company. Not only has its primary geographic market shifted from China to Hong Kong, but it has also experienced a substantial increase in profits. The company took several hits during COVID lockdowns due to forced closures and is now recovering from a harsh operating environment with a better competitive landscape.

Business Model

Most beauty service providers in Hong Kong employ a prepaid model, where customers purchase vouchers for service packages. These vouchers enable customers to visit their flagship service centers located in central areas a specified number of times to receive and complete their chosen treatments. During each visit, trained staff members perform pre-selected non-invasive medical beauty procedures. After completing the treatment a set number of times, the service package is considered finished.

Companies like Perfect Medical provide sales commissions to staff members when they successfully sell beauty vouchers. Generally, these vouchers have a limited validity period, and if customers fail to utilize them and complete their purchased treatments, the vouchers expire. In the case of Perfect Medical, these vouchers remain valid for one year. Expired vouchers are considered revenue and contribute to pure marginal profit for the company.

This prepaid model allows Perfect Medical and its peer Water Oasis (1161 HK) to maintain a negative working capital and net cash balance sheet. Theoretically, all earnings can be distributed without the need for retention as working capital in a steady state.

More importantly, customers are often not price-conscious as Perfect Medical targets the premium segment.They are unlikely to compromise their appearance or skin's well-being for a slight cost savings. To justify charging a high price, Perfect Medical and their competitors often advertise about the expensive devices used for the treatments, and have taken advantage of the lack of price transparency and comparability of the medical devices used and services. It is difficult to objectively assess or compare the effectiveness of treatments, but customers in general are willing to pay a high price if they feel they can enhance their appearances with a service provider they can trust.

Customers of Perfect Medical generally prepay upward of HK$ 20,000 for 8 to 10 treatments, equivalent to more than 1 month of median income in Hong Kong. The decision to purchase these services hinges on several key factors: confidence in the safety and effectiveness of the treatments, the quality of service, the convenience of the location, and the relationship with the sales staff. Furthermore, the assurance that the company will remain solvent and capable of fulfilling its service obligations is crucial. It is like selecting a hair stylist, the decision is less about cost and more about the value of trust and results in the customer-provider relationship.

Competition

While it is lucrative for Perfect Medical, the competition is day-and-night depending on the size of the business. Being a scaled player in the industry means that Perfect Medical, along with other well capitalized players can afford expensive medical devices which generally cost over HKD1M per device. Small mum-and-pop shops cannot afford such devices and hence can only offer lower-margin, more labor-intensive services such as nailing and manual facial treatments, and are more difficult to differentiate from competitions.

There are two competitors that are publicly listed: Water Oasis (1161 HK) and EC Healthcare (2138 HK). Water Oasis primarily operates in the mid tier markets with a well spread network of small service centers in Hong Kong. EC Healthcare’s aesthetic medical segment operates in the higher-end segment and provides more invasive treatments such as botox injection.

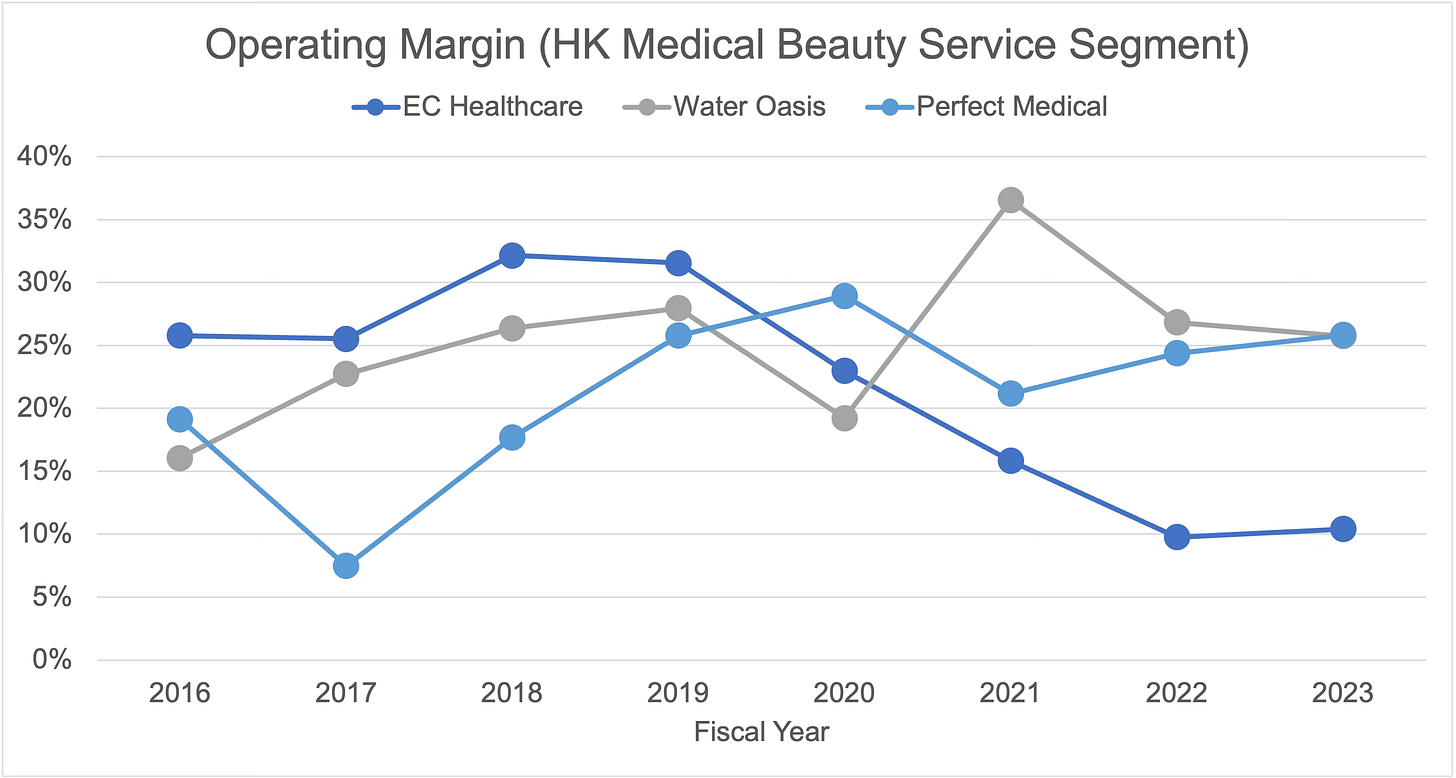

While the three listed companies and other well-capitalized service providers overlap in some of the services and arguably offer similar customer experience, the companies have taken advantage of the lack of price transparency and exhibit good price discipline. This is evidenced by the consistent operating margins (high!) of these players over the years except COVID times.

COVID was very tough to the whole industry because beauty service centers were required to close due to social distancing measures imposed by the Hong Kong government. The company, along with its peers, had to close their centers for 94 days in 2020, 48 days in 2021 and 104 days in 2022 respectively.1 While Perfect Medical along with its peers are still recovering from COVID, many small mum-and-pop shops were shut down as the lockdowns broke their businesses.

We believe the competition landscape for a well capitalized scaled player like Perfect Medical is more favorable as there are fewer small mum-and-pop shops coming out of COVID. The management continues to be optimistic on its prospect and has taken advantage of the lower rent to open new service centers.

Management

Besides an attractive industry and competitive landscape, we consider the management team at Perfect Medical agile and smart. The company’s pivot towards medical beauty services in Hong Kong in 2015 was a great example for the management’s agility to pursue the most profitable opportunities.

The management has been opportunistic with their expansion of service centers in Hong Kong. In 2021 when the rents came down because of the COVID in Hong Kong, they took the opportunity to secure a location in Time Square Tower, Causeway Bay for their new mega store. In a conversation with the CEO Dr Au Yeung, he shared that they adopt a trial and error approach with their service centers. If a new service center does not perform, they are happy to close it with a small loss and move the devices elsewhere.

During COVID times, the management actively looked for M&A and overseas expansion opportunities as their core market, Hong Kong, was heavily impacted by lockdowns. The management finally decided to experiment themselves organically in Australia and Singapore. Despite the mediocre performance after the initial success, we still appreciate the management’s ambition.

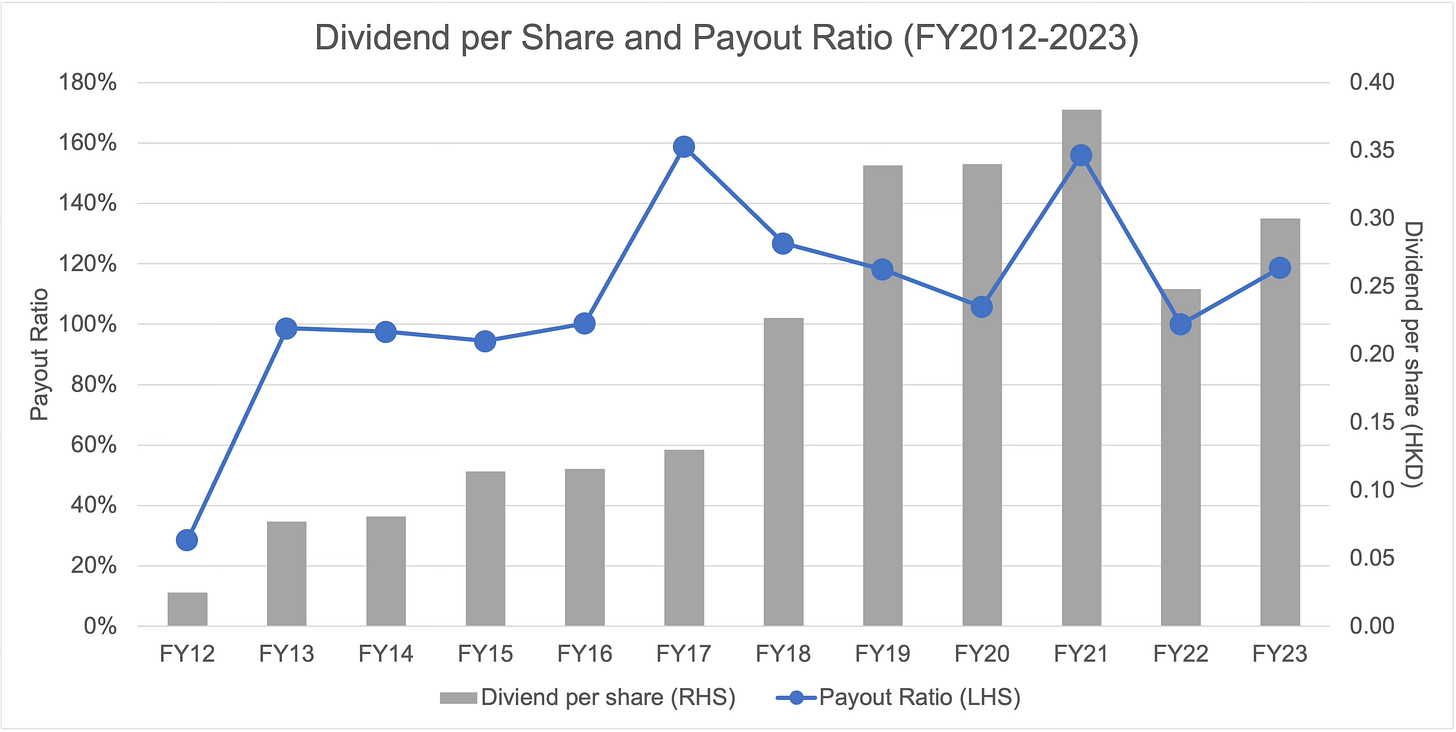

Dr Au Yeung owns 74.98%2 of the company and has a lot of skin in the game. For years, the management team has been very generous to shareholders by paying 100%+ of its reported net income while maintaining its growth.

Capital Allocation

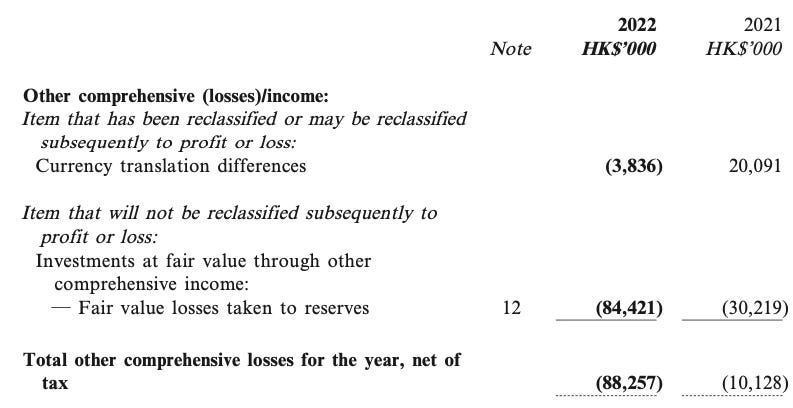

While shareholders have been rewarded handsomely throughout the years with dividend, the management however is not perfect with its capital allocation. As of 31 Mar 2021 when the bulls were running, the company held a stock portfolio with a cost of HKD241M. A fair value loss over HKD84M (over 33%!) was incurred in FY2022 under “other comprehensive (losses)/income”. We believe everything was in good intention but such a decision and the loss were not exactly creating values for shareholders. The management claimed that they have learnt a lesson and promised investors they will not do it again while still sitting on a HKD74M portfolio (unrealized losses of HKD55M) as of end of Sep 2023.

We prefer companies focusing on what they do the best in their business. Capital shall either be

Reinvested to generate more growth at good incremental return, or

Return to shareholders in the form of share repurchase or dividends when the first option is not available.

As discussed above, Perfect Medical’s business model is financed by prepayment and hence usually does not need to retain earnings for organic growth. We believe the cash earnings after capex shall be returned to shareholders in the form of share repurchase or dividends. Given the 75% insider ownership limit in Hong Kong listed companies and Dr Au Yeung’s current ownership of 74.98%, distributing all excess cash as dividends to shareholders makes the most sense.

Valuation

Perfect Medical currently trades at an undemanding 9% historical dividend yield at a share price of HKD3.31. Coming out of a COVID environment with a normal operating environment and easier competition landscape, if the management is able to resume their track record of double digit organic growth, we expect a very decent return.

The management is very ambitious in growing the business. In mid 2023, they set out a target to reach HKD3B of revenue and a net profit of HKD900M to 1B. They plan to achieve this target by opening more centers to a total of 50 globally in 3 years.

While we are not sure if they can make it given how ambitious the target is, we can dial back and assume a revenue growth at a 10% per year, a net profit margin of 23%, a dividend payout ratio of 110% and an forward exit yield of 8%, the IRR is 25% over a 3-year period.

Risks

Slow Return of Chinese Tourists’ Spending

The Chinese tourists visiting Hong Kong are now spending less. 5-star hotels and luxury stores in Hong Kong are no longer filled with Chinese tourists. The best place to look for Chinese tourists may now be McDonalds. In our conversation with management, we learnt that there has been no significant contribution of sales from Chinese tourists in Hong Kong, which previously was a meaningful part of its sales in Hong Kong. Their large service centers are running at low utilization in tourist areas such as Mongkok and Tsim Sha Tsui. While they are able to keep those centers profitable, a slow return of sales from Chinese tourists is hindering its growth post COVID.

Subpar Capital Allocation

As mentioned above, the management has made some mistakes on capital allocation. While it is true that the portfolio size is under HKD100M, it is still a fairly sizable one and the size was reduced simply because of a HKD55M loss. It is unlikely that they will further invest significantly in stock markets based on the message from the management. The fact that they are still keeping such a portfolio worries us. In our opinion, it is way better for the management to park their excess cash and prepaid cash from customers in time deposits or US treasuries earning over 4% of yield.

Limited Success in Overseas Expansion

The management expanded to Singapore and Australia during COVID due to the strict social distancing measures in Hong Kong. While there were some signs of success at the beginning, the overseas operations are now facing shrinking consumer spending and labor constraints. It is true that this management team has a record of being agile and moving quickly. Whether such traits will help them open up new paths of growth overseas remains uncertain.

Regulatory Changes

In Hong Kong, the regulatory framework for medical aesthetic treatments is notably lenient. There is no mandatory requirement for a doctor to be present during the administration of these treatments; instead, they can be conducted by individuals who have received training from a doctor. This regulatory environment enables the industry to set their fees at a "professional" level while avoiding the higher costs associated with employing medical doctors onsite. Perfect Medical has leveraged this model to expand into markets like Australia and Singapore, which have comparable regulatory standards. However, this approach carries the inherent risk of regulatory shifts. Should the regulations in these jurisdictions become more stringent, it could significantly impact the business model by introducing higher operational costs due to the need for qualified medical professionals.

Customer Complaints

Perfect Medical occasionally faces criticism over its aggressive sales tactics, as reported by some customers online. While these practices might reflect the ambition of the company's management or the zeal of certain sales personnel, the perception of aggressive selling can adversely affect the brand's reputation and customers’ trust over time.

Conclusion

It is true that the whole medical beauty service industry in Hong Kong is mature and Hong Kong is now facing some headwinds on consumer sentiment. Perfect Medical is certainly not perfect with the aforementioned concerns. We however believe it, as an agile and ambitious operator, has a good chance of capturing the opportunities created by a more favorable competition landscape while at the same time rewarding shareholders with generous dividend payouts. We believe that today’s valuation is not demanding and investors can earn a 9% yield without having to take into account much future growth of the business.

Disclosure

The author of this article owns shares in Perfect Medical (1830 HK).

This article is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities mentioned herein. Readers should conduct their own research and due diligence before making any investment decisions. Investing in stocks involves risks, and past performance is no guarantee of future results. The author assumes no responsibility for any losses incurred as a result of using this information.

The views and opinions expressed in this article are purely those of the author and do not reflect the official position of any organization they may be affiliated with. The author has not been compensated in any way by any of the companies mentioned in this article. Please note that the author may buy or sell shares of any of the companies mentioned in this article at any time without further disclosure.

Source: Annex I, Hong Kong Legislative Council’s Record of Proceeding on 11 May 2022: https://www.legco.gov.hk/yr2022/english/counmtg/hansard/cm20220511-translate-e.pdf

FY 2023/24 Interim Report

I looked at Perfect Medical recently. It has a solid track record for growing at a high return on capital. Dividend payout attractive. Was tempted but didn't pull the trigger. I read a lot of the customer reviews on google. Definitely get the impression that it is sales-oriented and perhaps not generating much customer loyalty. I wonder how much of sales are being gifted to friends/family. As for competition - read that Hong Kong Ferry Holdings (stock code 50, another bombed-out HK stock) is set to enter the business. What is to stop other cash rich property developers/investors from diversifying into these pseudo health care areas? My other concern is changing customer behavior - seems increasingly Asian women are more focused on exercise and diet and are less susceptible to these gimmicky 'slimming services' etc. But overall I see huge value in small caps in HK, stock may perform.

Enjoyed this analysis! I did the Esop valuation review for perfect shape for 3 years in a row and was always amazed at their high payout ratio. Now I understand why!