Following the positive response to our article on Perfect Medical, we are keen to introduce our readers to another noteworthy company in the healthcare and beauty industry, Water Oasis. Despite initial appearances suggesting sluggish revenue growth over the past decade, a deeper examination reveals significant improvements in business quality and consistent shareholder returns through substantial dividends. This under-the-radar company, we believe, presents an attractive risk-reward profile.

History

Water Oasis was founded in 1998 by Ms. Yu Lai Si, Mr. Yu Kam Shui Erastus, Ms. Lai Yin Ping, Mr. Tam Chie Sang, and Ms. Yu Lai Chu Eileen ("founders") as an exclusive distributor of an American beauty product brand ~H2O+ in Hong Kong. It opened its first retail outlet in Nov 1998 and since then has grown into Macau, Taiwan and China.

The company was not satisfied with just being a distributor and a retailer of beauty products. It began diversifying its revenue in the early 2000. The company started its spa business and opened its first spa center in 2000 under its own brand "Oasis Spa", providing a full range of beauty and massage services complemented with a complete line of ~H2O+ products. In addition to ~H2O+ products, “Oasis Spa” also uses other products for treatments provided in the Group’s spa centers. The Directors believe that the spa business provides synergy in promoting ~H2O+ products and broadening the market share of those products.

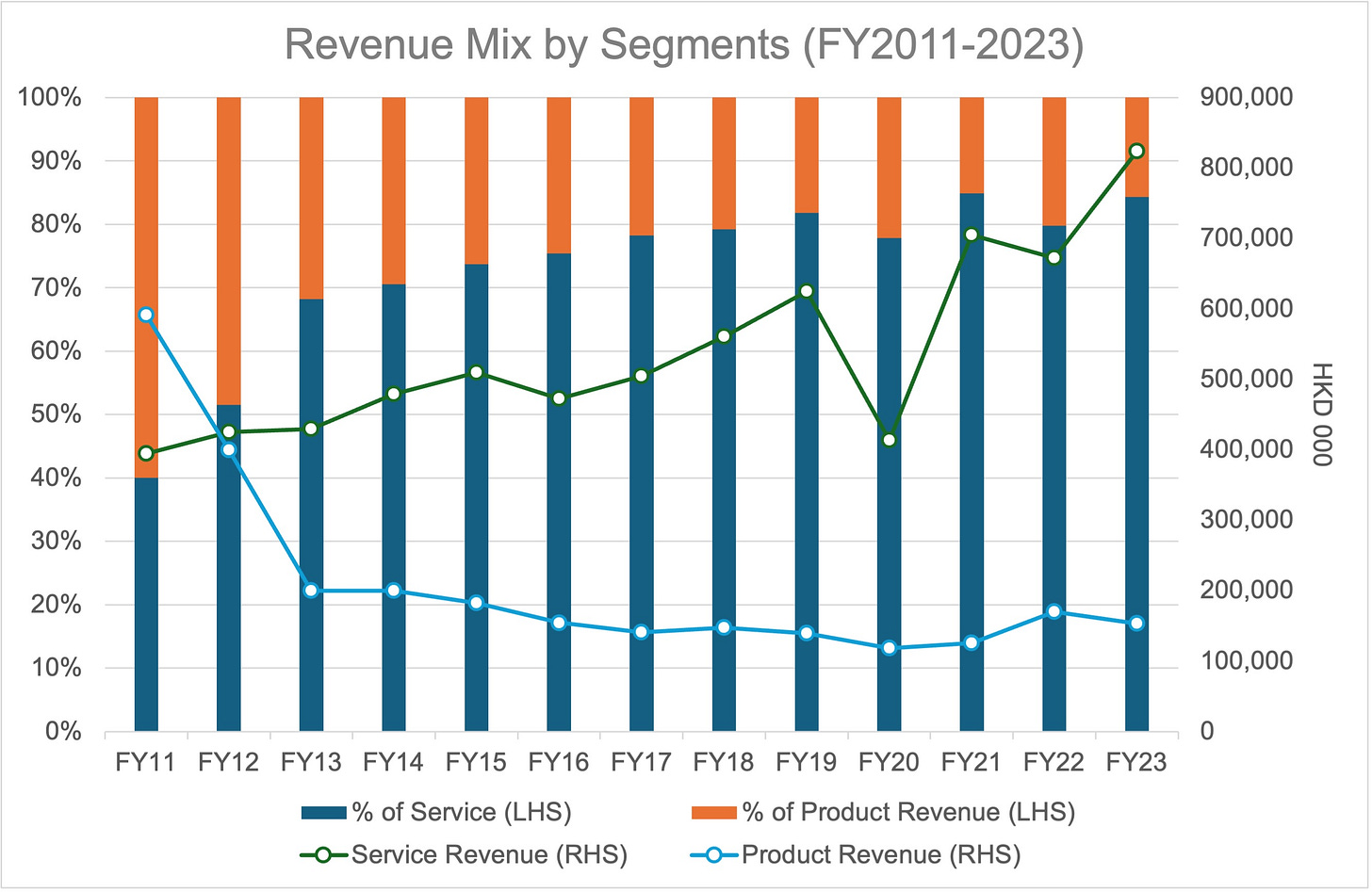

The company expanded into beauty service in 2002 using the brand Oasis Beauty. Oasis Beauty outlets offer affordable beauty treatment aimed at mass market consumers, making use mainly of ~H2O+ products. Since then, the beauty and spa businesses have continued to scale. Today, Water Oasis is now mostly a beauty and wellness service business with service revenue of 84.4% of total revenue as of FY2023.

Business

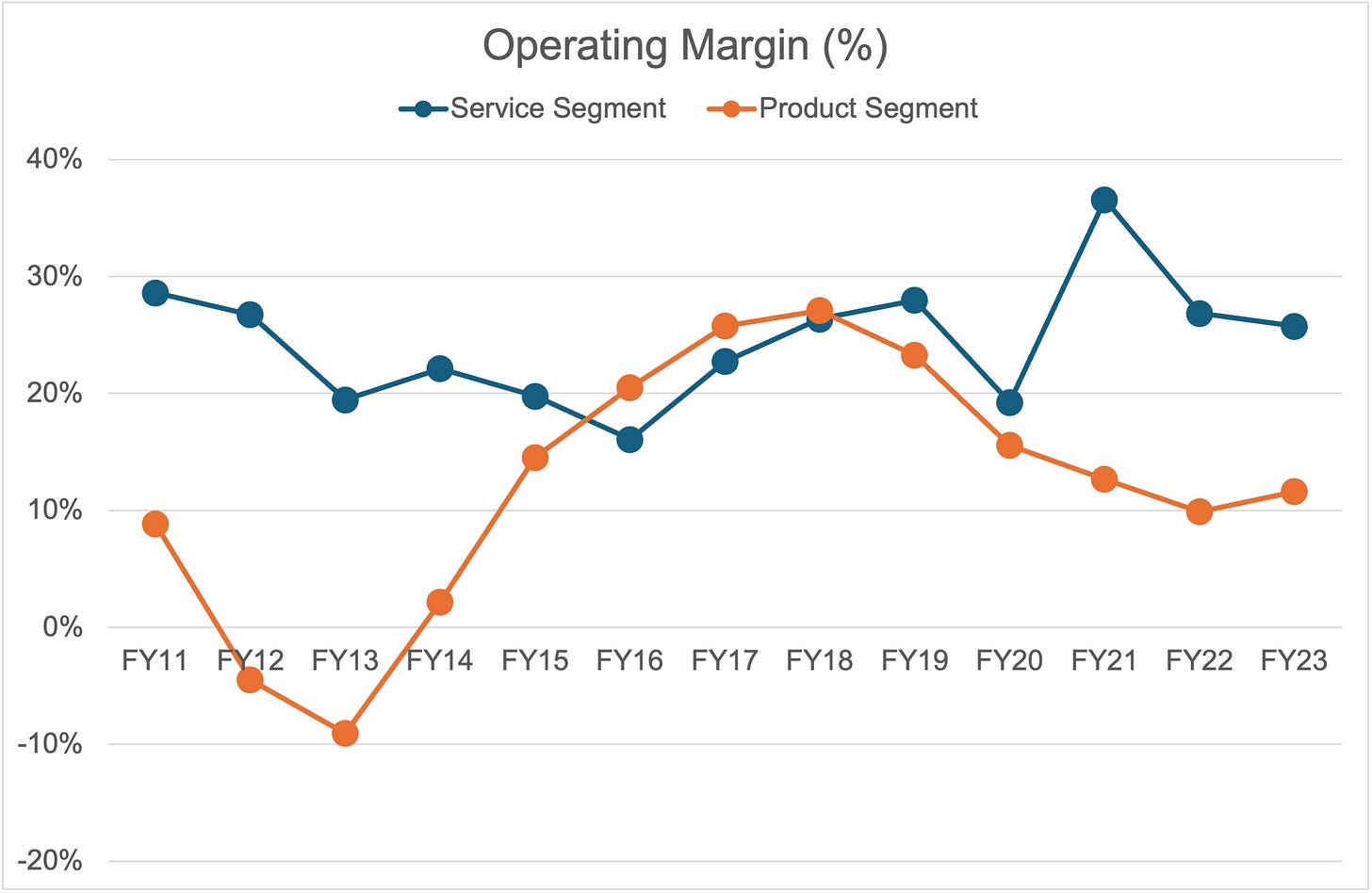

As of today, Water Oasis has two major segments of business: beauty services and product sales. Beauty Services today is the major driver of the company's growth and profitability, with a segment operating margin at 25.7% versus Product Sales's margin at 11.6% as of FY2023.

Beauty Services

Water Oasis's beauty services division encompasses an extensive array of beauty and spa services, serving as the primary engine for the company's growth and profitability. This segment caters to a broad spectrum of consumer demographics, offering specialized services to high-end, mid-range, and mass market segments across both genders. Compared to Perfect Medical, it is more on the mass market spectrum. A significant aspect of Water Oasis's strategy involves utilizing its own distributed products within its service centers and spas, leveraging these proprietary products as a key differentiator to attract and retain a diverse customer base.

As of FY2023, Water Oasis operates 64 service centers, predominantly in Hong Kong with 58 centers, and the remainder distributed between Macau and Beijing. Unlike Perfect Medical, which focuses on establishing flagship service centers in prime office locations, Water Oasis employs a strategy of positioning its centers in easily accessible shopping malls and residential areas. This strategic placement is reflected in their revenue figures: while Perfect Medical operates 11 centers in Hong Kong, generating an average revenue per center of HKD94.5M, Water Oasis's 58 centers in the same region only yield an average of approximately HKD12M per center.

The company's portfolio of service brands includes:

Oasis Beauty: Provides a comprehensive suite of beauty services tailored to meet the needs of both male and female clients across all market segments.

Oasis Medical: Specializes in medical aesthetic treatments administered under the supervision of medical professionals, focusing on non-invasive procedures alongside available injection treatments.

Oasis Hair Spas: Offers cutting-edge hair growth and scalp treatments, situated within Oasis Beauty centers.

Oasis Homme: Dedicated centers offering a range of facial and body treatments exclusively for men.

Oasis Spa: Delivers upscale beauty services and slimming experiences in a premium setting equipped with advanced beauty technologies.

Glycel Skin Spa: Features high-end beauty and spa services using Glycel’s line of products.

Oasis Dental: Introduced in 2022, this venture extends the group's offerings to include dental and cosmetic dental services, though it currently operates only one branch and is not yet a significant contributor to the company's financial performance.

Product Sales

This segment features a diverse retail distribution network with 15 locations in Hong Kong and Macau, along with a wholesale distribution operation in China. Water Oasis exclusively distributes several brands, including Glycel, Eurobeauté, DermaSynergy, HABA, and Erno Laszlo, which span a broad pricing range from premium to mass market. Notably, the distribution of H2O+ products ceased in November 2022.

Economically, this segment is significantly less lucrative than the service segment. However, with a shift towards service-oriented offerings, management believes there is synergy between the product and service segments. The company can capitalize on its exclusive distribution rights and utilize these products in their service centers to enhance the uniqueness of its services.

Competition

Beauty Services

As covered in our last article, Water Oasis and its peers operate in a relatively sheltered market environment, with opaque pricing mechanisms contributing to excess margin despite the competition. The COVID-19 pandemic further consolidated the market, eliminating weaker competitors and strengthening the positions of established players like Water Oasis and Perfect Medical.

The reputation of Water Oasis is better than peers as it allows customers to utilize expired vouchers and in deceased cases transfer their prepayment to relatives or friends. 80% of Water Oasis’s sales comes from existing customers whereas Perfect Medical only has about 50% of sales coming from existing customers.

Product Sales

The competitive dynamics shift markedly when considering the product sales segment. Here, Water Oasis faces intense competition from a plethora of global brands and online retail channels. The beauty industry is characterized by rapid product innovation and varying consumer preferences, making it a highly competitive arena. Brands under the umbrellas of industry giants such as Shiseido, Estée Lauder, and L'Oréal pose significant challenges, alongside independent brands that cater to niche market segments. The volatility in segment margins is a testament to the fierce competitive pressures and the need for strategic agility in product positioning and marketing.

Founding Family

The Water Oasis Group was established through the collaborative efforts of its founders, who are interconnected through familial ties. Ms. Yu Lai Si, Ms. Yu Lai Chu Eileen, and Mr. Yu Kam Shui Erastus are siblings. This family dynamic contributes to the complexity of the company's ownership structure, with various stakes held by different family members. As of September 2023, the collective ownership of the Yu family and their associates is estimated at 69.07% of the company. Although this represents a significant majority, the ownership is dispersed among the individual family branches.

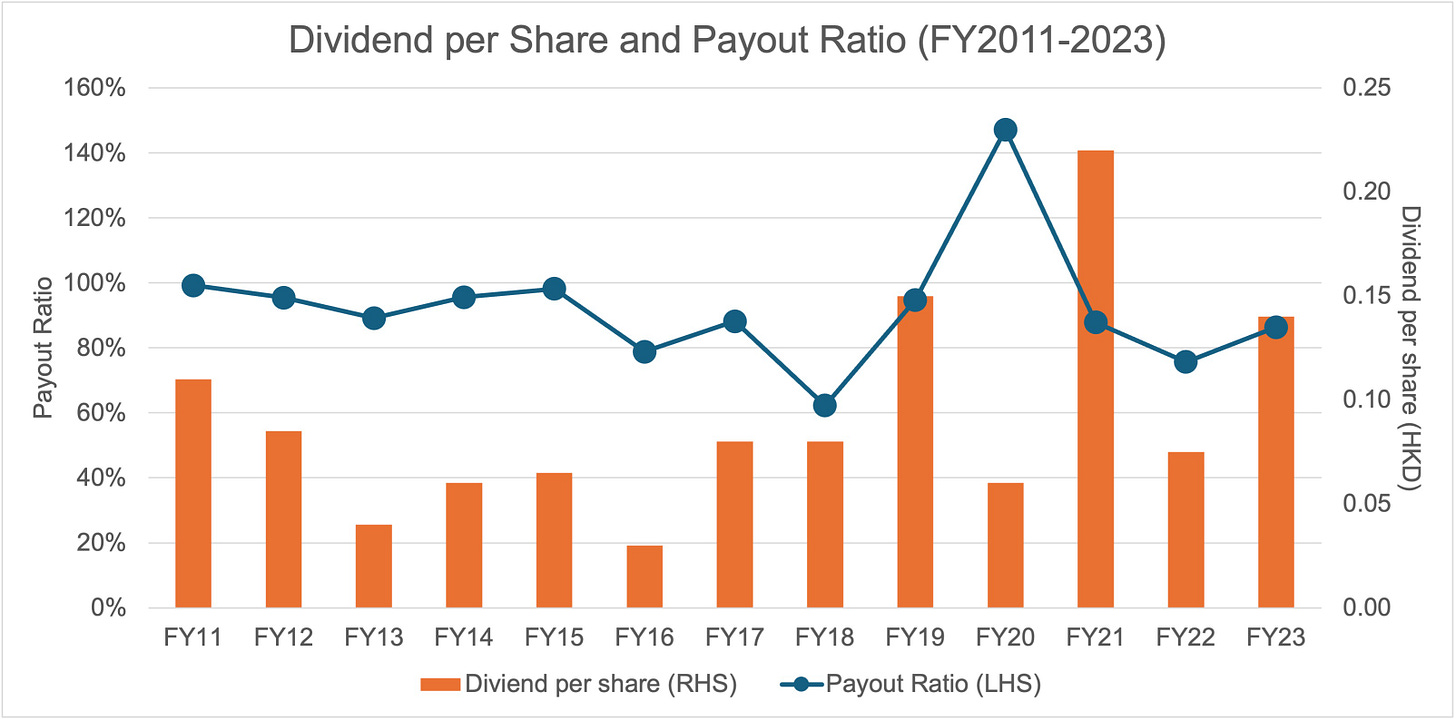

To ensure equitable treatment among different family branches, the company has adopted a policy of distributing all excess cash as dividends. This approach, driven by a board predominantly composed of Yu family members, is incentivised to maintain fairness in the allocation of profits within the broader family structure. Such a policy reduces conflict compared to retaining the majority of earnings within the company, especially when not all founders and their next generation are actively involved in the business. However, this structure may pose a problem in the future where not all founders have their next generation or successor to represent their interests.

Current Management

Leadership at Water Oasis has transitioned to the second generation of the founding family, with Tam Siu Kei (Alan), the son of Yu Lei Chu, steering the company as its Chief Executive Officer. Since joining the company in 1999, Mr. Tam has played a pivotal role for over two decades, notably spearheading the launch of Water Oasis's medical beauty services in Hong Kong and facilitating key strategic moves such as the acquisition of the Glycel brand and securing distributorship licenses for Erno Laszlo.

Historically, the company's management has maintained a low profile, seldom engaging directly with external investors. Nonetheless, their strategic decisions reveal an adeptness for timely business model pivots, notably shifting focus from product distribution to beauty services upon recognizing more favorable economic prospects in the latter. The product distribution arm continues to play a strategic role to help the company distinguish itself in a competitive market.

In an opportunistic expansion during the COVID-19 pandemic, Water Oasis acquired Millistrong Holdings Limited in June 2021. This acquisition included one beauty product brand with five retail outlets across Hong Kong and Macau, along with three beauty service brands operating seven service centers in Hong Kong. Despite the lack of details on the annual report, the management's efforts towards the integration of Millistrong Holdings have reportedly fostered growth and recovery.

Capital Allocation

Water Oasis has a track record of distributing on average of over 90% earnings to shareholders in dividends while growing the beauty service business. The dividend continues during COVID even though it was heavily impacted by the forced closure imposed by the social distancing restrictions in Hong Kong from 2020 to 2022.

Besides dividends, the company in 2018 repurchased 11% of its shares outstanding (88 million shares) at HKD0.8 per share with a conditional cash offer. The buyback was done at an attractive valuation (8.75x PE and 10% dividend yield based on FY2017 net income and dividend).

Water Oasis has been opportunistic with acquisitions. Throughout its over 20-year history, the company only made two, Glycel and Millistrong, which were peers of Water Oasis. Glycel was acquired in 2010 when Glycel was suffering losses. Millistrong was acquired in 2022 when COVID was severely impacting the beauty service industry in Hong Kong. The company bought Millistrong with a total cost of HKD42.42M and a multiple of 2.65x pre-COVID net income and 12.7x COVID level net income. Both Glycel and Millistrong experienced successful turnarounds post-acquisition.

Unlike Perfect Medical, the company currently does not invest in public securities1. The balance sheet is very clean with a net cash balance and a negative work capital thanks to the prepaid nature of the beauty service industry in Hong Kong.

Valuation

Water Oasis currently trades at an undemanding 10.2% historical dividend yield at a share price of HKD1.37. Assuming the revenue grows 10% in FY2024 and then 5% per year into 2027, if the margin gradually improves to 13% in FY2024 and then 14% in FY 2025, 14.5% in FY 2026 and 15% in FY 2027 with higher mix of service revenue, and dividend payout is kept at 85%, we estimate the IRR to be 31.3% with an exit dividend yield of 10%. With an easier competition landscape, if the management can deliver moderate growth, we expect a very decent return.

Risks

Regulatory Changes

As outlined in our preceding article, Hong Kong's regulatory landscape for medical aesthetic treatments is characterized by its leniency, allowing treatments to be administered by trained non-physicians. This framework supports the industry's ability to maintain professional fee structures while avoiding the costs of employing full-time medical doctors, a key factor in the favorable margins enjoyed by sector leaders.

Despite Water Oasis's diversified revenue base across spa services and product sales, the company is not insulated against the potential for regulatory tightening, which could lead to increased operational costs and affect its profitability.

Revenue Concentration in Hong Kong

Hong Kong's economic challenges [Link1][Link2] are noteworthy. By FY2023, Water Oasis sourced 92.6% of its revenue from Hong Kong and Macau, with minimal input from Macau. The company's conservative approach to overseas expansion contrasts with peers like Perfect Medical. Despite the inherent resilience of the medical beauty sector, it's not immune to local economic downturns and reduced consumer spending, posing significant risks to Water Oasis.

Potential Dispute with Previous Auditor

Deloitte resigned from Water Oasis’s auditor in Mar 2020. While the reason stated on the press release from Water Oasis was unfortunately quite vague, we believe it was due to the disagreement of how Water Oasis recognized its revenue. As stated above, Water Oasis allows customers to utilize expired vouchers. The company was reluctant to recognize expired vouchers as revenue and was heavily understating its revenue. Such an overly conservative accounting practice has stopped but this disagreement with Deloitte is worth flagging to our readers.

Customer Complaints

Like Perfect Medical, but to a lesser degree, Water Oasis's beauty service business has faced criticisms for aggressive sales tactics according to online customer feedback. Despite these reports, feedback from various sources indicates a range of experiences with the company's sales practices. However, the presence of online complaints warrants attention. If not addressed, aggressive sales strategies could significantly damage the brand's reputation and diminish customer trust over time.

Conclusion

Although Water Oasis might initially appear to be a company with limited growth prospects, a closer examination reveals a progressive improvement in earnings quality, particularly as the company expands its service segment, noted for its higher and more stable margins. The improving competitive landscape positions Water Oasis to potentially increase its market share alongside other major players. The current valuation of 10.1% dividend yield in our opinion is not demanding at all as little growth has been priced in.

Disclosure

The author of this article owns shares in Water Oasis (1161 HK).

This article is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities mentioned herein. Readers should conduct their own research and due diligence before making any investment decisions. Investing in stocks involves risks, and past performance is no guarantee of future results. The author assumes no responsibility for any losses incurred as a result of using this information.

The views and opinions expressed in this article are purely those of the author and do not reflect the official position of any organization they may be affiliated with. The author has not been compensated in any way by any of the companies mentioned in this article. Please note that the author may buy or sell shares of any of the companies mentioned in this article at any time without further disclosure.

Water Oasis subscribed to the IPO of Blue Moon Group (6993 HK) in late 2020. The final allocation was less than HKD1M and the shares were eventually sold.

Hi,

Thanks for the write-up, very informative.

I would like to challenge you on the growth assumptions that you use for the valuation of the company.

You assume revenue growth of 10% in FY 2024. However, the average revenue growth over the period of 2019-2023 has been about 6.3% ( from HKD 764 million in 2019 to HKD 977 million in 2023). Wouldn`t 10% then be to optimistic?

Furthmore, you assume that the margin to gradually improve to 15% in 2027, in part because of an increase in the service revenue as part of the total mix. However, the service revenue is already ~ 82% of the total mix, and has been round 80% for the last 5 years.

So it remains to be seen if service revenue can grow to 85%+ of the mix in addition to a potential margin improvement.

Perhaps i am looking to understand how you came to these assumptions to further understand the thinking about the valuation. In case you could provide any more light on this that would be fantastic.

Thanks!

With kind regards,

Jelle